Is Mr. Koon target 3.00 is achievable?

Daily chart: U-turn confirmed, most likely the game is over!

Weekly chart: Not confirm yet, you could hope a reversal.

Buy BITCOIN from LUNO Malaysia

Buy Bitcoin from LUNO Malaysia.

Enter code 9377NY, get MYR 25 in Bitcoin for both you and me! Get it on Google Play.

Luno Malaysia is one of three digital asset exchanges that have received conditional approval from the SC to trade in cryptocurrency. (from BERNAMA.com)

Saturday, 23 March 2019

AMVERTON: Return of the BULL, strong bull is in making!!!

Happy to see the price is showing strength. Let's the Bull ride up to 1.80 again...

Factors driving the bull:

1. Carey Island deep port...on or not on, pending feasibility by 3rd part to advise government. We need deep port, if not we're again given the business to Singapore easily, and Singapore will monopoly the deep port business. Singapore already expanding, we're still stay still...

https://www.scmp.com/week-asia/economics/article/2182645/cutthroat-shipping-industry-singapores-moves-increase-its-berth

https://www.theedgemarkets.com/article/govt-conduct-feasibility-study-carey-island-port

2. Strong earning from the compulsory land take over by government (I don't know which land as Amverton got a lot of huge land with very low acquisition price)

3. As usual, when stock super deeply undervalue, we sure can bull shit "TAKE IT PRIVATE" bla bla bla!

Factors driving the bull:

1. Carey Island deep port...on or not on, pending feasibility by 3rd part to advise government. We need deep port, if not we're again given the business to Singapore easily, and Singapore will monopoly the deep port business. Singapore already expanding, we're still stay still...

https://www.scmp.com/week-asia/economics/article/2182645/cutthroat-shipping-industry-singapores-moves-increase-its-berth

https://www.theedgemarkets.com/article/govt-conduct-feasibility-study-carey-island-port

2. Strong earning from the compulsory land take over by government (I don't know which land as Amverton got a lot of huge land with very low acquisition price)

3. As usual, when stock super deeply undervalue, we sure can bull shit "TAKE IT PRIVATE" bla bla bla!

HIL: Revisit after Sep 2015

My first post (24.Sep.2015) in AIM THE BULL is "Bull Shit" about HIL. After it went up to above 1.00 then I've cleared out major position and only remain some as a souvenir as a CASH RICH COMPANY.

After bonus issue and free warrant, it started weaken to 0.40 to 0.50. At this level of price, I've re-collected back some with the still like factors of its strong cash flow and price now is too attractive until I cannot "tahan" not to buy some.

Weekly chart show the breakout:

Now is started it breakout process, and the major shareholder keep buying in the open market. They do the same thing past few year (buying back) when HIL price is super cheap. The boss already hold 70%, I see no point they want to still continue to list it, better TAKE IT PRIVATE! This mean market not much public holding. If offer take private, I think should got at least 1.00.

After bonus issue and free warrant, it started weaken to 0.40 to 0.50. At this level of price, I've re-collected back some with the still like factors of its strong cash flow and price now is too attractive until I cannot "tahan" not to buy some.

Weekly chart show the breakout:

Now is started it breakout process, and the major shareholder keep buying in the open market. They do the same thing past few year (buying back) when HIL price is super cheap. The boss already hold 70%, I see no point they want to still continue to list it, better TAKE IT PRIVATE! This mean market not much public holding. If offer take private, I think should got at least 1.00.

Sunday, 17 March 2019

DELEUM: You will sure like it to hold, now offer 1.12!

Detected going to be explosive oil and gas stock. The power should be more explosive than DAYANG soon or will be equivalent to it.

One thing special to this company is a cash rich company and good dividend policy. Why? Because good time or bad time the company still making profit. Now it already confirmed bottom out and working hard to making a explosive uptrend line.

Making an explosive uptrend line:

Every year making profit.

Dividend payout record:

DELEUM BERHAD, an investment holding company, provides a range of specialized equipment and services to the oil and gas, and general industries. It offers specialized equipment and services, such as sub-sea production development equipment, gas turbine packages, and umbilicals, as well as technical and engineering support services. The company also provides oil filed equipment and services, including wire line and wellhead equipment and related services, offshore drilling rig operations, gas turbine overhaul and maintenance services, supply of gas turbine parts, and other oilfield equipment and technical services, as well as offshore drillings rigs and related services. In addition, it offers oilfield chemicals and other services, which include development and provision of solid deposit removal solutions for enhancement of crude oil production, and specialty chemicals and services. The company was founded in 1976 and is based in Kuala Lumpur, Malaysia.

One thing special to this company is a cash rich company and good dividend policy. Why? Because good time or bad time the company still making profit. Now it already confirmed bottom out and working hard to making a explosive uptrend line.

Making an explosive uptrend line:

Every year making profit.

Dividend payout record:

DELEUM BERHAD, an investment holding company, provides a range of specialized equipment and services to the oil and gas, and general industries. It offers specialized equipment and services, such as sub-sea production development equipment, gas turbine packages, and umbilicals, as well as technical and engineering support services. The company also provides oil filed equipment and services, including wire line and wellhead equipment and related services, offshore drilling rig operations, gas turbine overhaul and maintenance services, supply of gas turbine parts, and other oilfield equipment and technical services, as well as offshore drillings rigs and related services. In addition, it offers oilfield chemicals and other services, which include development and provision of solid deposit removal solutions for enhancement of crude oil production, and specialty chemicals and services. The company was founded in 1976 and is based in Kuala Lumpur, Malaysia.

Friday, 8 March 2019

Wednesday, 6 March 2019

Amverton: crazy undervalued stock

What's the point making so much money but the stock price still stagnant?

As a value investor, you must know undervalued stock turn out to be explosive stock is just a matter of time. The question is can you wait till that time?

So, boss of Amverton, pls work out something to make the stock price be proud of it!

As a value investor, you must know undervalued stock turn out to be explosive stock is just a matter of time. The question is can you wait till that time?

So, boss of Amverton, pls work out something to make the stock price be proud of it!

Tuesday, 5 March 2019

SEB: Seremban Engineering Bhd

Nice breakout, nice to KIV!

Latest financial performance result make a small loss, therefore, business need a boost, boss need to think something for SEB to make it able to make profit.

Also consider involvement in oil and gas business.

Latest financial performance result make a small loss, therefore, business need a boost, boss need to think something for SEB to make it able to make profit.

Also consider involvement in oil and gas business.

SEREMBAN ENGINEERING BERHAD, a Malaysia based company, is engaged in mechanical construction, maintenance, fabrication, erection and test commission for industries such as Rubber and Latex Processing Pant, Food Processing Plant, Ceramic Plant, Electronic Plant, Textiles Plant, Glass Manufacturing Plant, Palm Oil Refineries, Oleochemical, Biodiesel, and others. The company also undertakes fabrication of Oil Heaters, Unfired Pressure Vessels for Oil & Gas and Petrochemical Industries, Power Plants, and others. It is located in Senawang Industrial Park, Senawang, Malasia.

Sunday, 3 March 2019

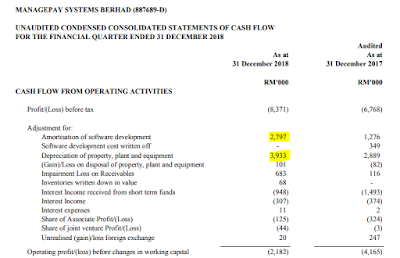

MPAY: new record of Revenue

Mpay is still making a loss, this can be understand from the high 6.6 million depreciation and amortisation of fixed asset. Therefore, to turn to profit or break-even, Mpay need to make additional 6.6 million revenue, or the depreciation / amortisation already reaching zero net book value.

Only trending above 0.14 will be considered successful bottom out, Now is too early to confirm. Nevertheless, the price still moving in positive outlook.

BPPLAS: Another grow!

Q4 BPPLAS revenue and profit grow again

Stock price is still cheap and on uptrend progressively (already confirmed bottom out). Current price is still a bargain to grab. I hope it can move up to 1.50 again.

2018 is an another new record revenue, profit reach back to 2015 grand level.

MPHBCAP 2018 Financial Performance

Q4 make almost break-even, annually 12 million profit. Both revenue and profit dropped parallel .

Nevertheless, cash is increasing (from 679 mil to 725 mil). This cash is from operating business, not from borrowing as I don't see any debt increased.

Weekly chart show the price back to weakness after last week strong bottom out. The direction of the price still in positive to move up, but in weak mode. That's mean it can come back to 1.00 again. So, let's see any movement for next week. I hope I can conclude the bottom or downward trend is ending.

Subscribe to:

Comments (Atom)