Buy BITCOIN from LUNO Malaysia

Monday, 22 April 2019

GADANG: Joined the Bandar Malaysia Theme Play

Daily Chart: Super strong breakout! So if you've missed it, wait for the correction (might come or might not)

Weekly chart:

If you monitor closely you can aware the trend change in 7 Jan 2019.

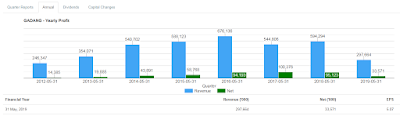

Revenue is going down, but the profit still there (just lower)

Dividend:

Thursday, 26 January 2017

GADANG

Gadang Holdings

(GADG MK, BUY, TP: 1.40)

On The Right Track

Results Review

Gadang Holdings (Gadang) remains a BUY after it recorded a sharp earnings recovery in 2QFY17 (May). This is further supported by its strong near-term earnings visibility, as well as its potential to win more projects in the near future. The stock is currently trading at less than 7x forward P/E vs its peers’ low teens P/E. Hence, this is another strong reason to accumulate the stock. Our SOP-based TP is unchanged, at MYR1.40 (35% upside).

Friday, 16 December 2016

Stock pick

Engineering & Construction Sector (OVERWEIGHT)

Contracts To Flow From Extended Infrastructure Cycle

Sector Update

The extended infrastructure cycle is likely to keep construction contracts flowing. Together with various affordable housing projects and several high-profile developments, this would keep local contractors busy in the coming years. Therefore, we reiterate our OVERWEIGHT stance on the sector. Our Top Pick for the sector is Gamuda for large-cap counters, while our preferred small-cap pick is Gadang.

Friday, 18 November 2016

Chinwel: still a profit but lower

Not sure next week will sell down or not? High possible short term players will rush to quit as they might expected better performance but end up lower profit.

But,

market is sometimes really unpredictable, announced higher profit but price went down (this can be link to theory of buy on rumors sell on fact).

But also,

it reflected correctly like GADANG, once announced lower profit, gap down sell.

But also,

i see some companies announced lower profit or even loss, price go up.

so,

what i can understand from here is price is telling you about future, not the history, not current. As a low profile and cash rich investors with better information than us, will react better than us.

Let's see how next week Chinwel perform. Of course i will keep it as long as the company financial performance is healthy. I will give it a chance and also at the same time train my patience. Is my excuse also :) as I hate to sell at loss if the company I think still got chance to fight back.

Monday, 14 November 2016

GADANG : They busy to promote to stabilize the price

Gadang Holdings (GADG MK, BUY, TP: MYR3.50)

A Buying Opportunity

Company Update

We believe the recent selldown provides a good opportunity to accumulate the stock at forward P/E of <7x vs the peer average (in low teens). We upgrade the stock to BUY with unchanged SOP-based TP of MYR3.50 (39% upside). Apart from strong medium-term earnings visibility, it has also laid foundation for the longer term. Mega construction job wins and its ongoing corporate exercise may boost sentiment on the stock.

Thursday, 27 October 2016

Thursday, 11 August 2016

(Share) Stock pick

Dear trader,

Potential stock to buy today:

11/08/2016

1) JHM (0127)

Price : RM1.35

Target price: RM1.60

Cut loss : RM1.15

* SYARIAH COUNTER*

2) MMSV (0113)

Price : RM0.680

Target price: RM0.750/ RM0.775

Cut loss : RM0.610

* SYARIAH COUNTER*

3) GADANG (9261)

Price : RM2.66

Target price: RM2.90/ RM3.10

Cut loss : RM2.41

* SYARIAH COUNTER*

4) DUFU (7233)

Price : RM0.645

Target price: RM0.700/ RM0.750

Cut loss : RM0.590

* SYARIAH COUNTER*

5) JAKS (4723)

Price : RM1.00

Target price: RM1.16

Cut loss : RM0.900

6) KSL (5038)

Price : RM1.19

Target price: RM1.39

Cut loss : RM1.08

* SYARIAH COUNTER*

Source : RHB RESEARCH INSTITUTE

Disclaimers: This trading ideas are issued and distributed in Malaysia by RHBIB only . The views and opinions in this ideas are our own as of the date hereof and is subject to change.

Wednesday, 10 August 2016

(Share) Stock Pick

House of Technical Idea (10/08/2016)

FBMKLCI 1672.68 (+8.64 +0.52%)

Support: 1650

Resistance: 1670, 1680, 1700

Market Overview:

Short term market is looks bullish with inmediate resistant at 1700. Breaking this level will open the possibility to 1730.

1) Stock Name: GADANG

Entry: ABOVE RM2.590

Target: RM2.700/3.000

Stop: BELOW RM2.530

2) Stock Name: DUFU

Entry: ABOVE RM0.635

Target: RM0.700/0.800

Stop: BELOW RM0.610

MATA Technical Division

Monday, 25 July 2016

(Share) Stock Pick

Dear trader,

Potential stock to buy today:

25/7/2016

1) CCB

Price : 3.48

Target price: 3.83

Cut loss: 3.16

Sector: Trading/services

***shariah

2) GADANG

Price entry : 2.36

Target price: 2.58,2.80

Cut loss: 2.24

Sector: construction

***Shariah

3) PENTA

Price entry: 0.89

Target price: 1.00

Cut loss: 0.825

Sector: Technology

*** Shariah

4) PASUKGB

Price entry: 0.205

Target price: 0.245

Cut loss: 0.175

Sector: Trading/Services

***Shariah

5) THHEAVY

Price entry: 0.115

Target price: 0.14

Cut loss: below 0.10

Sector: Trading/services

***Shariah

Source : RHB RESEARCH INSTITUTE

Disclaimers: This trading ideas are issued and distributed in Malaysia by RHBIB only . The views and opinions in this ideas are our own as of the date here of and is subject to change.

Friday, 22 July 2016

(Share) GADANG

Gadang Holdings (GADG MK, BUY, TP: MYR3.10)

Sustainable Earnings For FY17

Results Review

Gadang is our small-cap Top Pick in the construction sector. We think that its valuations remain undemanding despite its strong earnings visibility. The stock currently trades at about 6x forward P/E for FY17F, which is below our benchmark 1-year forward target P/E for small- and mid-cap construction stocks. We maintain our BUY call at a higher SOP-derived MYR3.10 TP (from MYR2.85, 33% upside) following our earnings revision. The company has proposed a first and final single-tier dividend of 7 sen for FY16.

Monday, 11 July 2016

Stock pick to share

Dear trader,

Potential stock to buy today:

11/07/2016

1) PENTA (7160)

Price : RM0.825

Target price: RM0.915/ RM1.00

Cut loss : RM0.755

* SYARIAH COUNTER*

2) TNLOGIS (8397)

Price : RM1.54

Target price: RM1.62/ RM1.79

Cut loss : RM1.38

* SYARIAH COUNTER*

3) KESM (9334)

Price : RM5.72

Target price: RM6.40/ RM6.90

Cut loss : RM5.25

* SYARIAH COUNTER*

4) GADANG (9261)

Price : RM2.18

Target price: RM2.45

Cut loss : RM2.03

* SYARIAH COUNTER*

5) MITRA (9571)

Price : RM1.33

Target price: RM1.62

Cut loss : RM1.25

* SYARIAH COUNTER*

6) MMSV (0113)

Price : RM0.545

Target price: RM0.615/ RM0.690

Cut loss : RM0.515

* SYARIAH COUNTER*

Source : RHB RESEARCH INSTITUTE

Disclaimers: This trading ideas are issued and distributed in Malaysia by RHBIB only . The views and opinions in this ideas are our own as of the date hereof and is subject to change.