This Friday show a good momentum buy.

Now we have to wait how the Management manage the RM 40 million assets purchase payback time!

Buy BITCOIN from LUNO Malaysia

Buy Bitcoin from LUNO Malaysia.

Enter code 9377NY, get MYR 25 in Bitcoin for both you and me! Get it on Google Play.

Luno Malaysia is one of three digital asset exchanges that have received conditional approval from the SC to trade in cryptocurrency. (from BERNAMA.com)

Saturday, 28 December 2019

AMVERTON: above resistance 1.15

Again, few factors I've suspected it "goreng" by,

1. Privatisation.

2. Carey Island Deep Port project. Amverton hold a big land there. Book value still at long long ago price.

3. tba...

AMVERTON COVE GOLF & ISLAND RESORT

~ Pulau Carey, Selangor ~

1. Privatisation.

2. Carey Island Deep Port project. Amverton hold a big land there. Book value still at long long ago price.

3. tba...

AMVERTON COVE GOLF & ISLAND RESORT

~ Pulau Carey, Selangor ~

Friday, 27 December 2019

HPMT: Big resistance 0.385-0.39 cleared

I monitored few days already, in fact the big sell block is just to afraid you to sell it below 0.38, then "they" can collect. I almost trap on this trick.

Now someone already "sapu" it. See below.

Now someone already "sapu" it. See below.

Wednesday, 18 December 2019

HPMT: on this boat now...

Aim the bull scanner "Chance" detected!

'Sapu" 0.385.

No bad as HPMT so far continuous making profit.

HPMT is involved in the manufacturing and distribution of cutting tools as well as trading of third party products of cutting tools, supporting equipment and accessories for metalworking. Our cutting tools are made for specific applications and are sold both locally in Malaysia as well as overseas. Currently, we distribute to more than 30 countries mainly in Europe and Asia under our own HPMT brand and for our distributors’ private labels.

The establishment of HPMT can be traced to the formation of Herroz in 1978 by Mr Khoo Yee Her. Back then, Herroz was principally involved in trading of cutting tools and other supporting equipment and accessories.

Today HPMT prides itself as an innovator in the three categories of high precision solid carbide cutting tools. The universal tools, the specialised tools and the customized tools categories. All with in-house R&D facilities committed to perfecting the art of precision tool innovation right from today’s advanced manufacturing hub of the technology-driven South East Asia. (from HPMT homepage)

'Sapu" 0.385.

No bad as HPMT so far continuous making profit.

HPMT is involved in the manufacturing and distribution of cutting tools as well as trading of third party products of cutting tools, supporting equipment and accessories for metalworking. Our cutting tools are made for specific applications and are sold both locally in Malaysia as well as overseas. Currently, we distribute to more than 30 countries mainly in Europe and Asia under our own HPMT brand and for our distributors’ private labels.

The establishment of HPMT can be traced to the formation of Herroz in 1978 by Mr Khoo Yee Her. Back then, Herroz was principally involved in trading of cutting tools and other supporting equipment and accessories.

Today HPMT prides itself as an innovator in the three categories of high precision solid carbide cutting tools. The universal tools, the specialised tools and the customized tools categories. All with in-house R&D facilities committed to perfecting the art of precision tool innovation right from today’s advanced manufacturing hub of the technology-driven South East Asia. (from HPMT homepage)

Tuesday, 17 December 2019

AMVERTON: Fund in!

Aim the bull abnormal scanner detected!

Today spike a lot!

Carey Island deep port project?

Privatisation?

Today spike a lot!

Carey Island deep port project?

Privatisation?

Property market still challenging. See the latest performance, only can break-even.

But Amverton got big land (Carey Island land) which is still carry long ago price. But, this is asset play, take time and only will be materialised if any takeover.

Amverton Berhad, through its subsidiaries, is engaged in development and construction of properties in Malaysia. The company is also involved in housing development, building construction, property management and development, operation of hotels and resorts, and cultivation of oil palm and sale of oil palm fruits. It is also engaged in trading and assembling automotive horns and other related products, trade of automotive products and industrial lubricants, manufacturing and distribution of automotive brake lining products and spark plugs. In addition, it is engaged in the management and operation of food and beverage business. The company was founded in 1978 and is based in Klang, Malaysia.

Monday, 16 December 2019

FPGROUP (5277)

Aim the bull scanner!

Every day making new high stock!

FoundPac Group Berhad principally involved in the design, development, manufacturing, marketing and sale of precision engineering parts to its customers in the semiconductor industry. The precision engineering parts that it design, develop, manufacture, market and sell are stiffeners, test sockets and hand lids. These precision engineering parts are used to facilitate the testing of ICs, also known as DUT.

Stock price and profit move parallel.

Every day making new high stock!

FoundPac Group Berhad principally involved in the design, development, manufacturing, marketing and sale of precision engineering parts to its customers in the semiconductor industry. The precision engineering parts that it design, develop, manufacture, market and sell are stiffeners, test sockets and hand lids. These precision engineering parts are used to facilitate the testing of ICs, also known as DUT.

Stock price and profit move parallel.

GDB (0198): Uptrend stock

Aim the bull scanner!

Making new high!

GDB Holdings Bhd. principally involved in the provision of construction services, focusing on high rise residential, commercial and mixed development projects as main contractor and principal works contractor. It involved in the implementation of construction projects, which includes daily management of all the works required for timely completion of the projects. It also engage subcontractors to provide certain services such as supply and installation of construction materials, machinery and equipment, and other specialised trade work such as mechanical and electrical engineering works, piping and plumbing works, external paint works, water proofing works and other related works

Continuously profit growing!

Making new high!

GDB Holdings Bhd. principally involved in the provision of construction services, focusing on high rise residential, commercial and mixed development projects as main contractor and principal works contractor. It involved in the implementation of construction projects, which includes daily management of all the works required for timely completion of the projects. It also engage subcontractors to provide certain services such as supply and installation of construction materials, machinery and equipment, and other specialised trade work such as mechanical and electrical engineering works, piping and plumbing works, external paint works, water proofing works and other related works

Continuously profit growing!

Saturday, 14 December 2019

BPPLAS: Loaded more to my portfolio

I like BPPLAS with consistent making profit and dividend payout. The current price still look cheap with expected growing profit.

Now the market is "goreng" packaging stock, I hope the next turn will be BPPLAS.

Introduction:

BP Plastics Holding Bhd, an investment holding company, is engaged in the manufacture and trading of plastic products to the garment and textile industries in Malaysia. The company's products include cast stretch films; lamination films; LDPE shrink films/bags; agriculture, construction film, and pallet cover and air cargo sheet; polyethylene and polypropylene garment packaging bags, and special slope cutting hanger hole polybag; UV protection and anti-static polybag; heavy duty sack; and industrial jumbo bag liners. It offers cast stretch film and plastic bags for industrial, commercial, logistic, and warehousing usage. The company was founded in 1990 and is based in Batu Pahat, Malaysia.

The cost control very efficient as you can see the revenue is lower, but the profit is growing.

Now the market is "goreng" packaging stock, I hope the next turn will be BPPLAS.

Introduction:

BP Plastics Holding Bhd, an investment holding company, is engaged in the manufacture and trading of plastic products to the garment and textile industries in Malaysia. The company's products include cast stretch films; lamination films; LDPE shrink films/bags; agriculture, construction film, and pallet cover and air cargo sheet; polyethylene and polypropylene garment packaging bags, and special slope cutting hanger hole polybag; UV protection and anti-static polybag; heavy duty sack; and industrial jumbo bag liners. It offers cast stretch film and plastic bags for industrial, commercial, logistic, and warehousing usage. The company was founded in 1990 and is based in Batu Pahat, Malaysia.

The cost control very efficient as you can see the revenue is lower, but the profit is growing.

Friday, 13 December 2019

MPHBCAP: No update!

ZZZzzzzz....quiet trading, smart investor still collecting quietly.

I've to wait the leader sheep finish the collecting, then only the M day will come.

MPI Generali Insurans Berhad (MPHBCAP valued company in term of financial but also stopper for MPHBCAP stock price)

I've to wait the leader sheep finish the collecting, then only the M day will come.

MPI Generali Insurans Berhad (MPHBCAP valued company in term of financial but also stopper for MPHBCAP stock price)

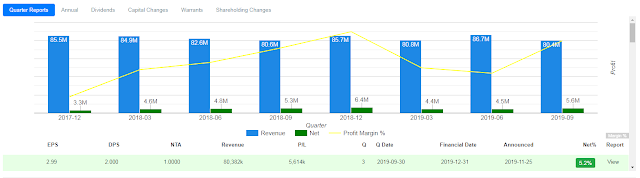

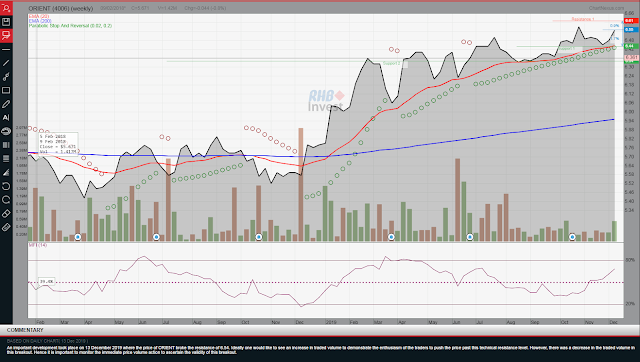

ORIENT: Better year ahead

Weekly chart:

Moving up trend despite foreign funds keep selling.

Improved of quarter profit. Expected next quarter will also has similar better profit.

Moving up trend despite foreign funds keep selling.

Improved of quarter profit. Expected next quarter will also has similar better profit.

Sunday, 8 December 2019

MPHBCAP: Smart investor at 1.05

Do you aware the smart investor is there collecting at 1.05?

This is for sure is the long term fight, only the patience investor will be rewarded.

Market cap only MYR 0.7 bill versus the intrinsic value MYR 2 billion is really a big gap match.

The only reason of this gap I can explain is due to the Financial Company status which all the cash and asset being locked by the Insurance business. So, it can only can be explosive once the insurance business has better arrangement.

This is for sure is the long term fight, only the patience investor will be rewarded.

Market cap only MYR 0.7 bill versus the intrinsic value MYR 2 billion is really a big gap match.

The only reason of this gap I can explain is due to the Financial Company status which all the cash and asset being locked by the Insurance business. So, it can only can be explosive once the insurance business has better arrangement.

Subscribe to:

Comments (Atom)