This Friday show a good momentum buy.

Now we have to wait how the Management manage the RM 40 million assets purchase payback time!

Buy BITCOIN from LUNO Malaysia

Buy Bitcoin from LUNO Malaysia.

Enter code 9377NY, get MYR 25 in Bitcoin for both you and me! Get it on Google Play.

Luno Malaysia is one of three digital asset exchanges that have received conditional approval from the SC to trade in cryptocurrency. (from BERNAMA.com)

Saturday, 28 December 2019

AMVERTON: above resistance 1.15

Again, few factors I've suspected it "goreng" by,

1. Privatisation.

2. Carey Island Deep Port project. Amverton hold a big land there. Book value still at long long ago price.

3. tba...

AMVERTON COVE GOLF & ISLAND RESORT

~ Pulau Carey, Selangor ~

1. Privatisation.

2. Carey Island Deep Port project. Amverton hold a big land there. Book value still at long long ago price.

3. tba...

AMVERTON COVE GOLF & ISLAND RESORT

~ Pulau Carey, Selangor ~

Friday, 27 December 2019

HPMT: Big resistance 0.385-0.39 cleared

I monitored few days already, in fact the big sell block is just to afraid you to sell it below 0.38, then "they" can collect. I almost trap on this trick.

Now someone already "sapu" it. See below.

Now someone already "sapu" it. See below.

Wednesday, 18 December 2019

HPMT: on this boat now...

Aim the bull scanner "Chance" detected!

'Sapu" 0.385.

No bad as HPMT so far continuous making profit.

HPMT is involved in the manufacturing and distribution of cutting tools as well as trading of third party products of cutting tools, supporting equipment and accessories for metalworking. Our cutting tools are made for specific applications and are sold both locally in Malaysia as well as overseas. Currently, we distribute to more than 30 countries mainly in Europe and Asia under our own HPMT brand and for our distributors’ private labels.

The establishment of HPMT can be traced to the formation of Herroz in 1978 by Mr Khoo Yee Her. Back then, Herroz was principally involved in trading of cutting tools and other supporting equipment and accessories.

Today HPMT prides itself as an innovator in the three categories of high precision solid carbide cutting tools. The universal tools, the specialised tools and the customized tools categories. All with in-house R&D facilities committed to perfecting the art of precision tool innovation right from today’s advanced manufacturing hub of the technology-driven South East Asia. (from HPMT homepage)

'Sapu" 0.385.

No bad as HPMT so far continuous making profit.

HPMT is involved in the manufacturing and distribution of cutting tools as well as trading of third party products of cutting tools, supporting equipment and accessories for metalworking. Our cutting tools are made for specific applications and are sold both locally in Malaysia as well as overseas. Currently, we distribute to more than 30 countries mainly in Europe and Asia under our own HPMT brand and for our distributors’ private labels.

The establishment of HPMT can be traced to the formation of Herroz in 1978 by Mr Khoo Yee Her. Back then, Herroz was principally involved in trading of cutting tools and other supporting equipment and accessories.

Today HPMT prides itself as an innovator in the three categories of high precision solid carbide cutting tools. The universal tools, the specialised tools and the customized tools categories. All with in-house R&D facilities committed to perfecting the art of precision tool innovation right from today’s advanced manufacturing hub of the technology-driven South East Asia. (from HPMT homepage)

Tuesday, 17 December 2019

AMVERTON: Fund in!

Aim the bull abnormal scanner detected!

Today spike a lot!

Carey Island deep port project?

Privatisation?

Today spike a lot!

Carey Island deep port project?

Privatisation?

Property market still challenging. See the latest performance, only can break-even.

But Amverton got big land (Carey Island land) which is still carry long ago price. But, this is asset play, take time and only will be materialised if any takeover.

Amverton Berhad, through its subsidiaries, is engaged in development and construction of properties in Malaysia. The company is also involved in housing development, building construction, property management and development, operation of hotels and resorts, and cultivation of oil palm and sale of oil palm fruits. It is also engaged in trading and assembling automotive horns and other related products, trade of automotive products and industrial lubricants, manufacturing and distribution of automotive brake lining products and spark plugs. In addition, it is engaged in the management and operation of food and beverage business. The company was founded in 1978 and is based in Klang, Malaysia.

Monday, 16 December 2019

FPGROUP (5277)

Aim the bull scanner!

Every day making new high stock!

FoundPac Group Berhad principally involved in the design, development, manufacturing, marketing and sale of precision engineering parts to its customers in the semiconductor industry. The precision engineering parts that it design, develop, manufacture, market and sell are stiffeners, test sockets and hand lids. These precision engineering parts are used to facilitate the testing of ICs, also known as DUT.

Stock price and profit move parallel.

Every day making new high stock!

FoundPac Group Berhad principally involved in the design, development, manufacturing, marketing and sale of precision engineering parts to its customers in the semiconductor industry. The precision engineering parts that it design, develop, manufacture, market and sell are stiffeners, test sockets and hand lids. These precision engineering parts are used to facilitate the testing of ICs, also known as DUT.

Stock price and profit move parallel.

GDB (0198): Uptrend stock

Aim the bull scanner!

Making new high!

GDB Holdings Bhd. principally involved in the provision of construction services, focusing on high rise residential, commercial and mixed development projects as main contractor and principal works contractor. It involved in the implementation of construction projects, which includes daily management of all the works required for timely completion of the projects. It also engage subcontractors to provide certain services such as supply and installation of construction materials, machinery and equipment, and other specialised trade work such as mechanical and electrical engineering works, piping and plumbing works, external paint works, water proofing works and other related works

Continuously profit growing!

Making new high!

GDB Holdings Bhd. principally involved in the provision of construction services, focusing on high rise residential, commercial and mixed development projects as main contractor and principal works contractor. It involved in the implementation of construction projects, which includes daily management of all the works required for timely completion of the projects. It also engage subcontractors to provide certain services such as supply and installation of construction materials, machinery and equipment, and other specialised trade work such as mechanical and electrical engineering works, piping and plumbing works, external paint works, water proofing works and other related works

Continuously profit growing!

Saturday, 14 December 2019

BPPLAS: Loaded more to my portfolio

I like BPPLAS with consistent making profit and dividend payout. The current price still look cheap with expected growing profit.

Now the market is "goreng" packaging stock, I hope the next turn will be BPPLAS.

Introduction:

BP Plastics Holding Bhd, an investment holding company, is engaged in the manufacture and trading of plastic products to the garment and textile industries in Malaysia. The company's products include cast stretch films; lamination films; LDPE shrink films/bags; agriculture, construction film, and pallet cover and air cargo sheet; polyethylene and polypropylene garment packaging bags, and special slope cutting hanger hole polybag; UV protection and anti-static polybag; heavy duty sack; and industrial jumbo bag liners. It offers cast stretch film and plastic bags for industrial, commercial, logistic, and warehousing usage. The company was founded in 1990 and is based in Batu Pahat, Malaysia.

The cost control very efficient as you can see the revenue is lower, but the profit is growing.

Now the market is "goreng" packaging stock, I hope the next turn will be BPPLAS.

Introduction:

BP Plastics Holding Bhd, an investment holding company, is engaged in the manufacture and trading of plastic products to the garment and textile industries in Malaysia. The company's products include cast stretch films; lamination films; LDPE shrink films/bags; agriculture, construction film, and pallet cover and air cargo sheet; polyethylene and polypropylene garment packaging bags, and special slope cutting hanger hole polybag; UV protection and anti-static polybag; heavy duty sack; and industrial jumbo bag liners. It offers cast stretch film and plastic bags for industrial, commercial, logistic, and warehousing usage. The company was founded in 1990 and is based in Batu Pahat, Malaysia.

The cost control very efficient as you can see the revenue is lower, but the profit is growing.

Friday, 13 December 2019

MPHBCAP: No update!

ZZZzzzzz....quiet trading, smart investor still collecting quietly.

I've to wait the leader sheep finish the collecting, then only the M day will come.

MPI Generali Insurans Berhad (MPHBCAP valued company in term of financial but also stopper for MPHBCAP stock price)

I've to wait the leader sheep finish the collecting, then only the M day will come.

MPI Generali Insurans Berhad (MPHBCAP valued company in term of financial but also stopper for MPHBCAP stock price)

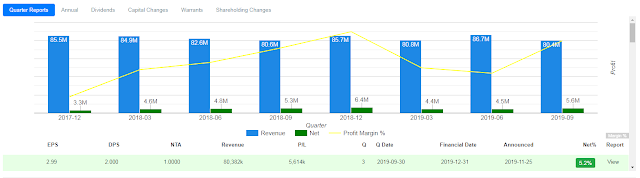

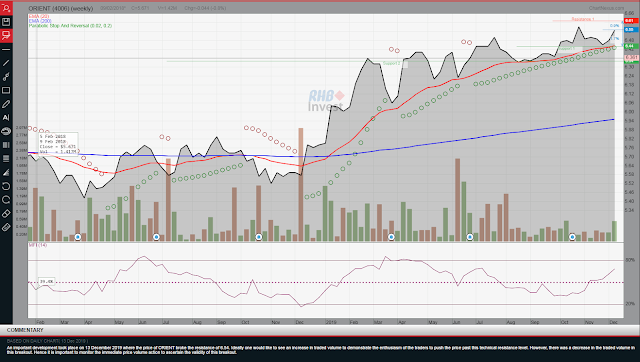

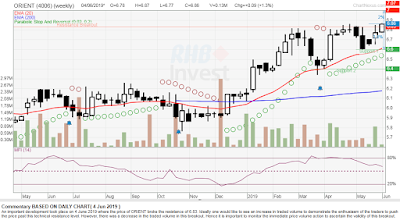

ORIENT: Better year ahead

Weekly chart:

Moving up trend despite foreign funds keep selling.

Improved of quarter profit. Expected next quarter will also has similar better profit.

Moving up trend despite foreign funds keep selling.

Improved of quarter profit. Expected next quarter will also has similar better profit.

Sunday, 8 December 2019

MPHBCAP: Smart investor at 1.05

Do you aware the smart investor is there collecting at 1.05?

This is for sure is the long term fight, only the patience investor will be rewarded.

Market cap only MYR 0.7 bill versus the intrinsic value MYR 2 billion is really a big gap match.

The only reason of this gap I can explain is due to the Financial Company status which all the cash and asset being locked by the Insurance business. So, it can only can be explosive once the insurance business has better arrangement.

This is for sure is the long term fight, only the patience investor will be rewarded.

Market cap only MYR 0.7 bill versus the intrinsic value MYR 2 billion is really a big gap match.

The only reason of this gap I can explain is due to the Financial Company status which all the cash and asset being locked by the Insurance business. So, it can only can be explosive once the insurance business has better arrangement.

Saturday, 23 November 2019

HIL: going up hill soon!

Impressive Q3 financial performance 8.7 mil profit and the trend down look like ending already.

Super cash rich company and dividend expected will be higher payout for this year financial.

Super cash rich company and dividend expected will be higher payout for this year financial.

Saturday, 16 November 2019

MPHBCAP: Update 15.Nov.19

Weekly TA data:

R1: 1.14

R2: 1.16

S1: 1.05

S2: 0.985

1.10 Psychology Resistance

This is my long term fight!

R1: 1.14

R2: 1.16

S1: 1.05

S2: 0.985

1.10 Psychology Resistance

This is my long term fight!

Saturday, 9 November 2019

MPHBCAP: Free Aim The Bull Explosive Chart and Explanation!

What you can see? How to interpret it? This is Free, I give you free, no need money.

If you've money, just buy and this is at your own risk!

Blue dot line EMA 1.08, this is pivotal price point. For MPHBCAP meaning is going to create a bull run if the bear can be transformed or evolved into Bull (condition running above 1.08)

Red line is the big picture where is the price position.If it can cross over the top line, then we can see the BREAKOUT! If it cannot move above the top line, still follow the bottom line, mean the downtrend will still continue. The Triangle Box what you see now is the downtrend and it still cannot confirm whether it is able to break the wall or shift the box to upward.

The green line is the short term trend line. This is the signal of Buy or Sell. In this case is the Buy.

B team is working hard for the collection and they already accidentally release the Buy signal. Therefore it attract some sensitive traders (maybe only 1% people know) notice, and they're already rushed in to the ship, that's why you able to see the green line in the uptrend.

S team is still there whereby they need cash for their personal agenda, they will still selling and B team will still collecting until the day come.

The day mean the Aim The Bull Massive Shooting day. Whereby everyone is rushing to buy at whatever of the price until they satisfied they're already get involved.

This is all the price recording for the action from the investors and traders.

So, what is the reason behind this action? I called it New Value Creation!

What is the value creating such action? I guessed this is most probability due to the MPHBCAP insurance business agenda and from value investor point of view is such the company value (big land...) missed match by the stock market price. This is Hypothesis Inefficient risk in the market (Boss don't like). Also, this is an opportunity for you for this inefficiency pricing.

You can read what I have commented before at this blog.

If you've money, just buy and this is at your own risk!

Blue dot line EMA 1.08, this is pivotal price point. For MPHBCAP meaning is going to create a bull run if the bear can be transformed or evolved into Bull (condition running above 1.08)

Red line is the big picture where is the price position.If it can cross over the top line, then we can see the BREAKOUT! If it cannot move above the top line, still follow the bottom line, mean the downtrend will still continue. The Triangle Box what you see now is the downtrend and it still cannot confirm whether it is able to break the wall or shift the box to upward.

The green line is the short term trend line. This is the signal of Buy or Sell. In this case is the Buy.

B team is working hard for the collection and they already accidentally release the Buy signal. Therefore it attract some sensitive traders (maybe only 1% people know) notice, and they're already rushed in to the ship, that's why you able to see the green line in the uptrend.

S team is still there whereby they need cash for their personal agenda, they will still selling and B team will still collecting until the day come.

The day mean the Aim The Bull Massive Shooting day. Whereby everyone is rushing to buy at whatever of the price until they satisfied they're already get involved.

This is all the price recording for the action from the investors and traders.

So, what is the reason behind this action? I called it New Value Creation!

What is the value creating such action? I guessed this is most probability due to the MPHBCAP insurance business agenda and from value investor point of view is such the company value (big land...) missed match by the stock market price. This is Hypothesis Inefficient risk in the market (Boss don't like). Also, this is an opportunity for you for this inefficiency pricing.

You can read what I have commented before at this blog.

Saturday, 2 November 2019

SEB (SEREMBAN ENGINEERING BERHAD): Another Strong Bull in Making

They are all in to make such a Powerful wave, powerful new management team, powerful syndicate. All of them is ready to push SEB to a coming Super Star Stock! Let it rock and roll!

I guessed only! :)

I'm all in!

I guessed only! :)

I'm all in!

Monday, 21 October 2019

Sunday, 13 October 2019

Affin: Head up for its low 1.94!

Just catch the falling knife, but is too cheap for me to ignore him! Wish for special dividend if insurance business able to change hand!

AXA, Affin mull options for Malaysian insurance business worth US$650m

I heard one big Europe insurance going to take it!

Sunday, 6 October 2019

MPHBCAP: Just rebound again from 1.04 low

No much time left (option end May 2020) for MPHBCAP to think how to deal with the insurance business MPI Generali Insurans Bhd. 2 possible situations could be happened in next few months.

Situation:

1. Italian Generali Group sell the 49% to MPHBCAP.

2. MPHBCAP sell the remaining 21% share to Generali Group.

Situation 2 unlikely happen as Bank Negara will block it again with no reason given again.

So, situation 1 will likely happen.

But how MPHBCAP able to fund the purchase as the company cash flow will stuck with this huge re-purchase share.

So, MPHBCAP need to find a strategic way e.g. find a partner to eat the 49% shares, or sell the 49% to another Insurance company.

No matter how, MPHBCAP will not able to "telan" back the 49%, boss need to find a way! Boss will not "telan" it as he don't like Insurance business, that is what I think about him.

What will Generali do with its stake in MPHB’s insurance subsidiary MPI?

https://www.theedgemarkets.com/article/what-will-generali-do-its-stake-mphbs-insurance-subsidiary-mpi

Rebound Chart:

Again, I will still continue buy MPHBCAP as I think at price 1.12 now is still a price mismatch to the real value of the company.

Situation:

1. Italian Generali Group sell the 49% to MPHBCAP.

2. MPHBCAP sell the remaining 21% share to Generali Group.

Situation 2 unlikely happen as Bank Negara will block it again with no reason given again.

So, situation 1 will likely happen.

But how MPHBCAP able to fund the purchase as the company cash flow will stuck with this huge re-purchase share.

So, MPHBCAP need to find a strategic way e.g. find a partner to eat the 49% shares, or sell the 49% to another Insurance company.

No matter how, MPHBCAP will not able to "telan" back the 49%, boss need to find a way! Boss will not "telan" it as he don't like Insurance business, that is what I think about him.

What will Generali do with its stake in MPHB’s insurance subsidiary MPI?

https://www.theedgemarkets.com/article/what-will-generali-do-its-stake-mphbs-insurance-subsidiary-mpi

Again, I will still continue buy MPHBCAP as I think at price 1.12 now is still a price mismatch to the real value of the company.

Sunday, 15 September 2019

MPHBCAP: why you must have it in your portfolio?

Because you going to get the insurance business free!!!

This is not fake, this is not a joke, this is ABSOLUTELY TRUE, FAIR AND CORRECT!

Especially at current price 1.10!

Watch the 2013 video which recommended by Maybank Investment! Although is 2013 recommendation, as it today I still think it is still valid and reasonable fair value for MPHBCAP!

This is not fake, this is not a joke, this is ABSOLUTELY TRUE, FAIR AND CORRECT!

Especially at current price 1.10!

Watch the 2013 video which recommended by Maybank Investment! Although is 2013 recommendation, as it today I still think it is still valid and reasonable fair value for MPHBCAP!

Thursday, 12 September 2019

MPHBCAP: Price is getting cheaper when the profit getting bigger

Weekly Chart:

Collecting, keep collecting as the stock is super cheap!

Look the the weekly chart, is slowly moving upward but someone is stopping it.

I'm not sure why, but I think someone want to collect cheap and try to stop the price moving up.

The insurance business issue need to settle next year end of May as the put option is due soon!

2019 sure is the bigger profit year and 2020 sure a GREAT YEAR for MPHBCAP!!!

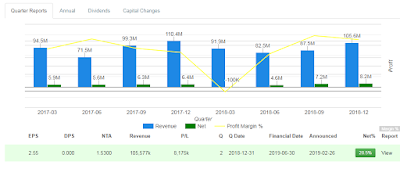

Quarterly PNL

Annual PNL (Q2 YTD)

Wednesday, 5 June 2019

MPHBCAP: Historical Low! Mismatched in asset and market value!!!

What is cooking inside to make it so low (historical low)?

I guessed privatisation is the only the answer or the company going to make a tsunami loss in financial performance! Privatisation is most likely...i guessed!

Quarterly financial performance:

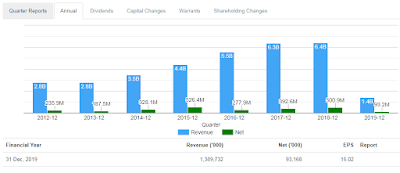

ORIENT: A perfect diversified holding company!

Oriental Holdings Berhad, an investment holding company, is engaged in automotive and related products, plastic products, hotels and resorts, financial services, plantation, and property development businesses in Malaysia and Singapore. It operates in six segments: Automotive and Related Products, Plastic Products, Hotels and Resorts, Investment Holding and Financial Services, Plantation, and Others. The Automotive and Related Products segment involves in the retail, assembly, and distribution of motor vehicles; manufacture of engines, seats, and other related parts; and trade of spare parts, accessories, and related component parts. The Plastic Products segment manufactures, assembles, and distributes plastic component parts; and manufactures plastic technical and industrial goods and equipment. The Hotels and Resorts segment operates as an hotelier. The Investment Holding and Financial Services segment invests in shares and bonds, as well as is engaged in letting properties, and providing leasing services. The Plantation segment is engaged in the cultivation of oil palm. The Others segment develops residential and commercial properties. This segment is also engaged in the provision of management, marketing, advertisement, and central reservation services; provision of freight forwarding, and shipping and commission agency services; manufacture of wire netting, wire mesh, barbed wire, weld mesh, nails, and building materials; and the distribution of cement, and also manufacture and trade of concrete products. Oriental Holdings Berhad is based in Penang, Malaysia.

Daily:

Weekly:

Annual financial performance:

Quarterly:

Dividend:

Daily:

Weekly:

Annual financial performance:

Quarterly:

Dividend:

Sunday, 12 May 2019

UZMA: another potential oil & gas stock

UZMA is an investment holding company. Through its subsidiaries, UZMA provides Geoscience & Petroleum Engineering Services, Drilling and Well Services, Laboratory Services, Project Oilfield & Operation Services, Oilfield Manpower Services and Oilfield Chemical & Services and personnel placement and management systems. it has operations in Africa, Middle East, the Indian Sub-continental, South East Asia and Australia.

Daily:

Weekly: still in the waiting to breakout mode

Annual:

Quarterly:

Daily:

Weekly: still in the waiting to breakout mode

Annual:

Quarterly:

Dividend: long time no dividend since 2015.

Subscribe to:

Comments (Atom)