Buy BITCOIN from LUNO Malaysia

Buy Bitcoin from LUNO Malaysia.

Enter code 9377NY, get MYR 25 in Bitcoin for both you and me! Get it on Google Play.

Luno Malaysia is one of three digital asset exchanges that have received conditional approval from the SC to trade in cryptocurrency. (from BERNAMA.com)

Wednesday, 9 December 2020

Saturday, 4 July 2020

Friday, 19 June 2020

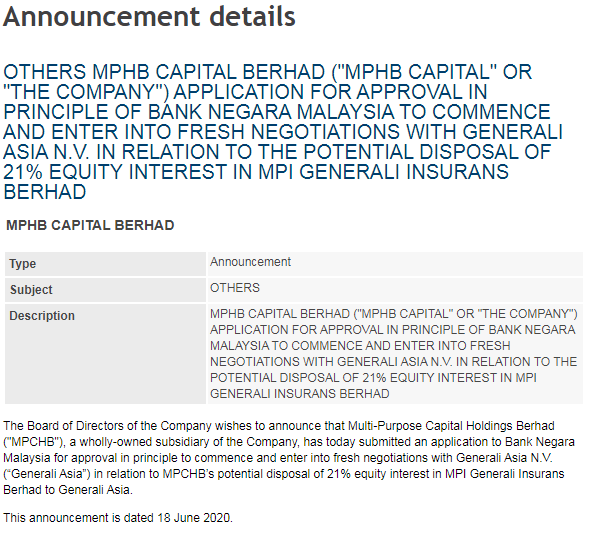

MPHBCAP: The change game resume?

I hope this time you could have a successful and completion sale off insurance business and unlock the cash and asset.

Today the investors reaction is not so interested with this old news. I'm in fact boring too as the Bank Negara always play as a stopper. Nevertheless, this time I think they already got the Pre-approval from Bank Negara, that's why they now only proceed with the admin job. I hope this assumption is true and the deal actually all done, now only complete the last phase of admin job.

Price reaction also look boring :)

Today the investors reaction is not so interested with this old news. I'm in fact boring too as the Bank Negara always play as a stopper. Nevertheless, this time I think they already got the Pre-approval from Bank Negara, that's why they now only proceed with the admin job. I hope this assumption is true and the deal actually all done, now only complete the last phase of admin job.

Price reaction also look boring :)

Saturday, 16 May 2020

SEB: waiting oil & gas charging bull!

Cold stock, low profile and quiet as no much volume due to liquidity.

But, this type of stock normally is explosive stock once the catalyst hit in.

The company start making profit, nevertheless due to Covid19, it retreat from 0.60 to 0.50.

I believed it will be going to become explosive stock due to its new management, new boss and new many projects.

I've this stock in my portfolio.

I've this stock in my portfolio.

Quarter: Start making profit!

Annual: after new management, the company now at break even level (only make a small profit). Last few years the financial performance really in deep shit.

So, if the company 2020 start making profit, what will happen to the stock price? It going to be very explosive stock!

Friday, 15 May 2020

BPPLAS: COVID19 only impact to BPPLAS temporary!

No matter what business, you still need to pack and send!

1. all your gloves send to customer also need to pack right?

2. now forwarder business very good due to online business especially PosLaju, but you also need to pack and send to customer right?

Oh....Yes!

This is simple to explain why BPPLAS still able to make profit because you still need to pack right!

Also, it consistently give 2 sen dividend every quarter, better than your bank!

I got hold this stock!

COMFORT & RUBEREX: Reaching the peak

Let's see COMFORT could make another peak or not.

Chance is not so high, but who know COVID19 beside killing people also able to push the stock to another limit!

I'm watching only, no buy no sell.

Chance is not so high, but who know COVID19 beside killing people also able to push the stock to another limit!

I'm watching only, no buy no sell.

Tuesday, 12 May 2020

HIL: invisible hand acquiring!

After AMVERTON privitisation at 1.20, I believed the same boss will launch another privatisation for HIL as the company also at deep discounted market value and the stock not liquid.

I hope this time they can at least offer 1.00.

The price no impact from covid19 impact as it still stay at 0.5X.

I hope this time they can at least offer 1.00.

The price no impact from covid19 impact as it still stay at 0.5X.

Subscribe to:

Posts (Atom)